Whether or not you have to pay VAT (value added tax) depends on the shipping destination.

If we have to ship your order to a country inside the EU then we are obliged to add VAT.

If we have to ship your order to a country outside the EU then we don’t have to add VAT. Keep in mind though that the customer may have to pay import duties or import taxes on their order! In most cases you can import up to a certain amount without paying import duties. This varies from country to country, and may be 400 euro, 800 euro, or any other amount. Please check this with your customs department. It’s impossible for The Canyon Store to keep track of all import laws worldwide.

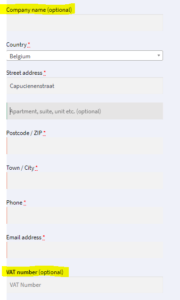

If in doubt, check the VAT test article: The price should be shown as an amount of minimum € 1.18 incl. VAT (€ 1.00 excl. VAT) and maximum € 1.27 incl. VAT (€ 1.00 excl. VAT) if you select a ship to country within the EU. Between 18 and 27% VAT is charged for delivery inside the EU, depending on the destination. We must charge the VAT rate of the destination country (click here for the list of current VAT rates)

The price of the VAT test article should be shown as € 1.00 incl. VAT (€ 1.00 excl. VAT) if you select a ship to country outside the EU. 0% VAT is charged for delivery outside the EU.

The price of the the VAT test article should also be shown as € 1.00 incl. VAT (€ 1.00 excl. VAT) if you enter a valid (non-Belgian) VAT number. 0% VAT is charged for intra-community deliveries.

Please note: If you have a valid European VAT number then you can enter it in the last step of your order, just before payment. The VAT number will be checked against the VIES database of the European Commission, and if the VAT number is valid then the VAT-amount will be automatically subtracted (this is called an intra–community delivery).